Last week in Barcelona, SPARK 2025 confirmed what we already knew: the financial system is moving onchain, and it’s accelerating. Across every session, one thing was clear: the infrastructure decisions we make today will define how seamlessly this transition happens.

1. The Onchain Future is Here (and faster than we thought)

In the nine months since our last SPARK, the industry has crossed the chasm. We’ve gone from early adoption to full institutional scale, and it’s happening in three waves:

- Crypto was the first wave — unlocking global liquidity and market participation. It set the foundation.

- Stablecoins are the second wave — the bridge between crypto and mainstream finance, bringing payments onchain.

- Tokenized real-world assets (RWAs) are the third wave — securities, treasuries, and funds moving onchain, with new standards for compliance, security, and distribution. This is where the financial system goes fully digital.

This shift requires a new standard of infrastructure. We’ve built our product strategy on four core pillars to reflect it:

- Achieving New Levels of Scale

- Setting a New Bar for Security

- Simplifying Compliance

- Building Global Payment Rails

Leading up to SPARK, we announced the launch of the Fireblocks Network for Payments, which seamlessly connects customers to stablecoin providers across 100 countries and 60+ currencies, including on/off-ramps, stablecoin liquidity and swaps and issuers. This global, connected ecosystem of local payment rails, major blockchains, stablecoin issuers, liquidity and compliance providers are all integrated with one API, making it faster and more efficient for customers to launch stablecoin payments while maintaining compliance. We have launched the network with 40 global providers and will be adding dozens of new providers every quarter.

The Network for Payments will continue to evolve along with our vision of an end-to-end infrastructure for the stablecoin economy that’s centered around connectivity, interoperability and reduced friction.

At SPARK, we also shared a preview of what’s next on our product roadmap. More to come as those features roll out.

2. Stablecoins are Reshaping Global Finance

A common theme throughout the conference, and which Goldi reiterated both on and off stage, is that stablecoins will “eat the world.” No longer a side story, stablecoins are fast-becoming the backbone of global finance.

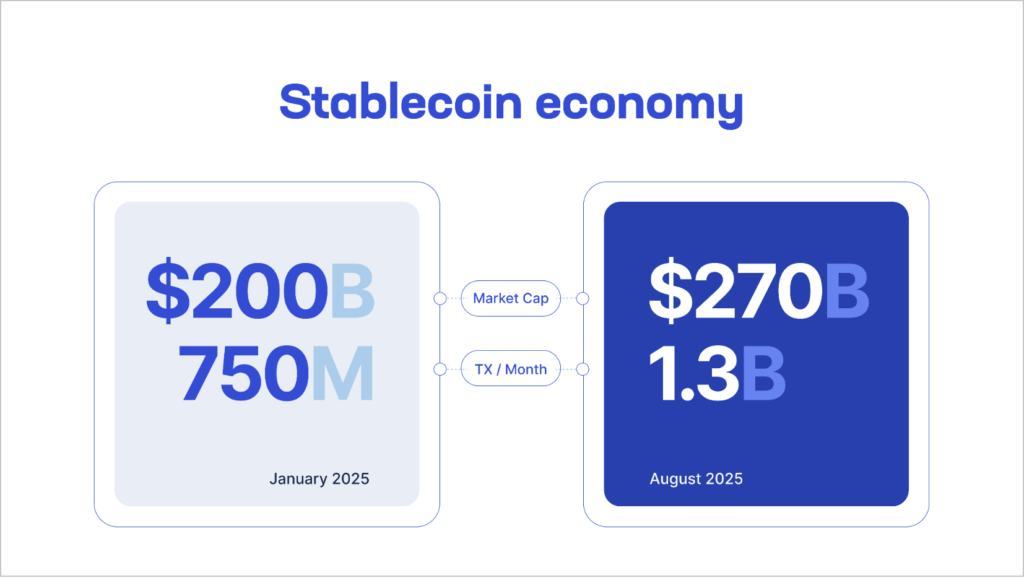

In the past year, the global stablecoin market cap has grown from $200 billion to $270 billion, representing a 35% increase. Transaction volumes surged from 750 million to 1.3 billion per month, roughly the same ballpark monthly transaction volumes as SWIFT.

My discussion with Circle CEO Jeremy Allaire highlighted how we’ve reached a pivotal stage of building real applications using stablecoin money within both U.S. and global financial systems. The focus has moved beyond digital assets to onchain FX and fully composable financial markets, enabling use cases across:

- Payouts and on-ramps: we see this from the likes of Moonpay, Worldpay, and Bridge where institutions are looking to distribute funds to a wide range of recipients globally. Using stablecoins here is much more efficient and transparent.

- B2B cross-border payments: companies like Conduit and Zodia Markets are looking to support a traditional business needing to engage with cross-border payments by using stablecoins to reduce cost, settlement time and increase payment reliability.

- Access to USD: for countries with high inflation or extremely volatile currencies, stablecoins act as dollar accounts for institutions and retail to protect them against these fluctuations and instability.

While other, newer use cases are emerging (pay-ins for goods and services, FX activity, trade finance, and even machine-to-machine payments for AI agents), there are still some major gaps that need to be addressed: FX availability, consumer accessibility for crypto and stablecoin accounts, friction and fragmentation in compliance protocols, and operational scalability.

3. Banks are On Board

The narrative around banks has fundamentally evolved from cautious optimism to practical application. During the panel with our banking partners hosted by Stephen Richardson, it became evident that with banks coming on board, it’s changing both the speed of adoption and global volume of onchain finance.

With 15 of the 25 largest global banks having announced stablecoin or tokenization initiatives in the past year, they are now hyper-focused on secure custody and stablecoin payments.

In 2023 banks weren’t considering launching their own stablecoin capabilities, and wouldn’t open accounts for companies touching crypto. But in the past 18 months, there’s been a dramatic shift in our team’s conversations with banks. They are actively leaning in, largely due to regulatory tailwinds and the real business value from use cases such as stablecoin payments and trading. Continued active engagement between regulators and industry leaders is crucial for building the framework that will support the next phase of digital asset adoption.

4. Partnership Ecosystem Driving Innovation

The announcements at SPARK 2025 showcased how our partnership ecosystem is accelerating institutional adoption:

- Staking: Figment integration with Fireblocks Trust Company brings regulated staking; Lido liquid staking expands into DeFi collateral.

- Security: Station70 and CoinCover extend institutional-grade protection to individual users and backup solutions.

- New Markets: Stellar and 21X are building the first regulated secondary market for tokenized securities under the EU DLT Regime; TRES Finance enables AI-powered compliance and treasury management.

We also announced new integrations with Lynq, Chainalysis, and 30 additional blockchains — bringing Fireblocks support to over 120.

Looking Ahead

SPARK 2025 made it clear: the question is no longer if or when. It’s how. The infrastructure we’re building today — security, compliance, and connectivity — is defining how seamlessly finance transitions onchain.

As we expand our network and partnerships, one thing is constant: Fireblocks is the infrastructure layer making this transition secure, compliant, and scalable.

Banks are tokenizing deposits. Asset managers are integrating staking. Treasury teams are automating workflows with AI. The conversations at this year’s SPARK confirmed what we’ve known to be true all along: the future of finance is here, and we’ve got the infrastructure to support it.