The strategic conversation around stablecoins has moved beyond innovation labs and pilot programs. It’s now a focus in executive leadership meetings and shareholder reports.

In June, Bank of America’s CEO highlighted stablecoins as a potential new form of transaction account, one the industry must be ready for. SMBC has signed a multi-party MOU to explore wholesale stablecoin infrastructure. These are signals of a global shift, and our State of Stablecoins 2025 report confirms it: stablecoins are mainstream infrastructure priority.

After all, among nearly 300 financial institutions we surveyed globally, 49% report using stablecoins today, and another 41% are in the pilot or planning phase. That includes Tier-1 banks, regional institutions, and globally-regulated financial players, all pursuing ways to modernize payments, treasury, and settlement infrastructure.

As our CEO Michael Shaulov observes, we’re past the ‘why’ stage. For banks, the conversation has turned decisively to how to execute.

Banks Are Already in the Game—Silently, Strategically, and Globally

Stablecoin adoption is often assumed to be the domain of fintechs or crypto-native firms. But in reality, traditional financial institutions are moving with purpose. Many just haven’t been broadcasting it, until now.

The State of Stablecoins 2025 survey reveals that nearly half of all institutions (49%) are already using stablecoins for payments. This cohort includes not only forward-leaning fintechs but also Tier-1 banks, regional players, and established lenders. These institutions may be taking different paths, but the destination is the same: modernized payments and treasury infrastructure.

Examples abound. Bancolombia, the country’s largest commercial bank, has launched a stablecoin (COPW) through its Wenia platform to enable real-time, programmable settlement for retail users. In Europe, Banking Circle issued EURI, a MiCA-compliant stablecoin, specifically to serve B2B platforms and cross-border PSPs.

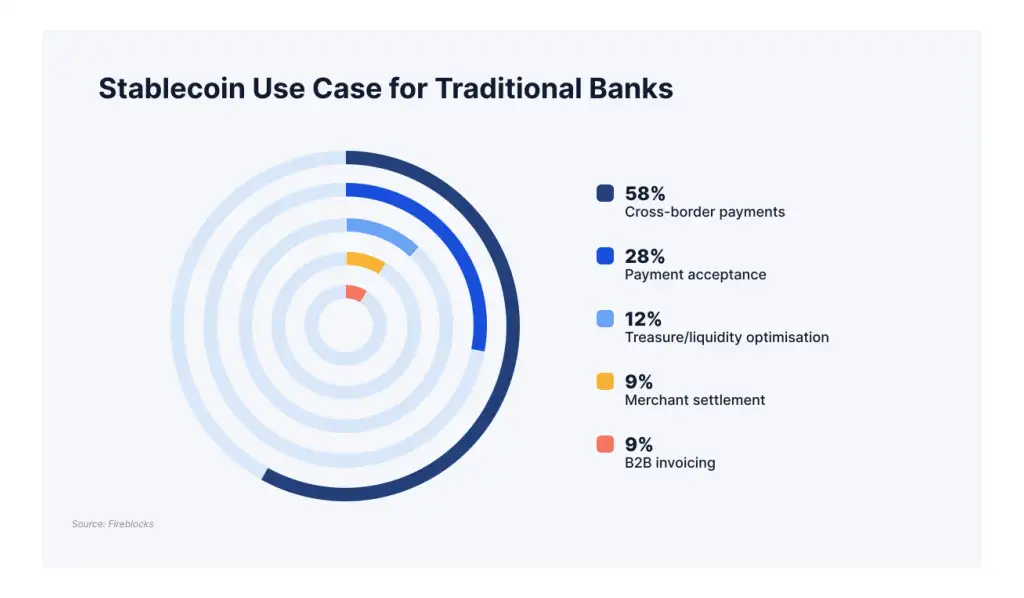

And in the U.S., as regulatory momentum builds, traditional banks acknowledge relevant use cases, with cross-border payments leading the way.

Put simply: the banks are already here. The question now is how they scale. And how they lead.

Revenue, Liquidity, and Access Are Driving Strategy

The strategic rationale for stablecoins is increasingly focused on revenue generation, market expansion, and operational agility—not just cost efficiency.

In the State of Stablecoins 2025 survey, 48% of respondents cite faster settlements as the top benefit of stablecoin adoption, followed by 36% who point to greater transparency and 33% who highlight both integrated payment flows and improved liquidity management. By contrast, only 30% reference lower transaction costs. This prioritization marks a decisive trend: stablecoins aren’t just a cheaper way to move money. They’re a smarter way to move money faster, into more places, and with greater impact.

Banks are recognizing the potential for stablecoins to unlock speed-to-revenue in business lines like corporate treasury, merchant settlement, and B2B cross-border flows. By shortening the time between transaction and settlement, stablecoins help release trapped capital and increase throughput across financial systems.

This shift has real implications for competitive positioning. Banks that wait may not lose relevance overnight—but they risk eroding margins, ceding market share, and weakening relationships with clients demanding faster, programmable financial infrastructure. The institutions acting now are building the capabilities to scale these solutions securely and confidently.

What’s driving these strategies? It’s not crypto-native enthusiasm. It’s business fundamentals.

Regulation Is Becoming a Catalyst, Not a Constraint

In 2023, regulatory uncertainty was one of the top concerns for financial institutions—85% cited it as a barrier to stablecoin adoption. This year, that number has dropped to just 25%.

That shift is related to real momentum in regulatory clarity. In the U.S., the proposed GENIUS Act is helping set clearer standards for stablecoin issuance, reserves, and banking relationships. At the same time, the Office of the Comptroller of the Currency has taken a concrete step forward. OCC Interpretive Letter 1184 reaffirmed that federally regulated banks may custody crypto and offer related services without prior approval, so long as they meet expectations around safety, soundness, and compliance. Progress like this is a big reason why 88% of North American financial institutions now view regulation as a favorable force shaping the industry’s direction.

Europe’s MiCA framework is translating policy into production. Banking Circle’s euro-denominated stablecoin (EURI) launched under the new regime. Société Générale recently announced the launch of its second MiCA-compliant token, USD CoinVertible, with reserve custody provided by BNY Mellon. These stablecoins are designed for use cases spanning 24/7 payments, FX, settlement, and collateral, all enabled under MiCA.

In Asia, Japan’s amended Payment Services Act now formally recognizes stablecoins as electronic payment instruments. SMBC’s new stablecoin initiative aims to operationalize a wholesale stablecoin infrastructure for interbank payments and settlement of tokenized financial assets.

For banks, this moment represents a narrowing window to shape infrastructure that aligns with supervisory expectations while gaining competitive advantage. Waiting for complete clarity isn’t a strategy. Acting within the current frameworks—many of which already exist—is.

Enterprise-Grade Infrastructure Is the Next Competitive Frontier

According to the State of Stablecoins 2025 report, 41% of institutions cite fast and reliable payouts as non-negotiable, and 34% point to compliance and transparency as essential infrastructure criteria. This signals that enterprise-grade performance is no longer optional—it’s expected.

Yet readiness is uneven. Many banks still lack the foundational capabilities to offer stablecoin-based services at scale. That includes real-time wallet infrastructure, embedded transaction screening, and multi-network connectivity that supports global settlement workflows.

Building this infrastructure is not a future requirement—it’s a current one. As stablecoins move deeper into mission-critical payment flows, banks must evolve their systems to keep pace with institutional demand and regulatory expectations.

To remain competitive, banks should:

- Invest in digital rails that support real-time, cross-border transactions

- Develop in-house expertise in crypto and blockchain technologies

- Partner with proven platforms to accelerate go-to-market strategies

- Pursue regulatory clarity proactively rather than reactively

Banks’ stablecoin infrastructure must deliver throughput, interoperability, and trust. This is what turns stablecoins from a niche innovation into a financial backbone.

A Strategy Worth Defining

The strategic rationale is no longer up for debate. Stablecoins are now part of the infrastructure conversation inside banks—and increasingly, part of the product roadmap. The institutions that move early will be the ones best equipped to shape market standards, define operational best practices, and deliver differentiated value to clients.

At Fireblocks, we’re working with leading banks to define those strategies. We’re ready to do the same with you.