1 min. read

How Worldpay achieves 50% faster payment processing with the Fireblocks Payments Engine

Benefits at a glance

T+0 settlement

Achieves 24/7/365 settlement with merchants in T+0, enhancing operational and merchant capital efficiency.

Fast time- to-market

Built and launched stablecoins payment solutions within weeks.

Diversification of revenue opportunities

Expands into new market segments and creates a differentiated product offering for existing customers.

Mitigation of risk exposure

Avoids stablecoins on its balance sheet, reducing exposure to market volatility and operational risks and enhancing financial security and stability while complying with regulatory standards.

Worldpay is the world’s largest payment processor, processing over $2.2 trillion in payments annually across 146 countries and 135 fiat currencies. As a business that is continually exploring innovative solutions to enhance their merchant experience and expand into new markets, Worldpay began to explore how they could leverage blockchain-based payments to substantially improve merchants’ capital efficiency.

Challenge: The search for Faster Merchant Settlements

Worldpay identified settlement speed as an area of growth for merchants across the globe. Nabil Manji, SVP/GM, Head of Crypto and Web3 at Worldpay, explains, “A capital-efficient merchant needs payments to settle quickly to keep their daily liquidity in line. Many people don’t realize that when you pay a merchant with a credit card, that merchant doesn’t get paid until a few days later – with money moving through three or four different intermediaries.”

The traditional banking system is limited by a narrow window of settlement opportunities, allowing merchants to access funds only during operating business hours, excluding weekends and holidays. This results in extended processing times, with regular transactions often taking three to four business days. While over $30 billion of consumer payments are processed every weekend globally, merchants cannot receive those funds because of these settlement limitations. “In today’s interest rate environment, there are several billion dollars of forgone interest income that merchants cannot realize because they cannot settle outside traditional banking operating hours,” Manji continues.

Additionally, opening a business bank account in the United States can be difficult for foreign businesses, mainly due to regulatory compliance requirements. U.S. banks typically require a company to have a physical office address in the United States to open an account, which is often infeasible because securing an office lease usually requires having a U.S. bank account. This creates difficulties, especially for non-crypto merchants who want to settle in USD, sparking their interest in blockchain payment rails to settle using USD stablecoins.

Worldpay recognized that the complexity of the traditional banking system was simply unable to support its ambitions to provide merchants with faster settlement services. Manji expounds, “Speeding up settlements sounds like an easy thing to implement, but when you’re a PSP that operates in dozens of countries and supports over 100 currencies, doing faster settlements with fiat rails means that you need to integrate with a lot of real-time settlement systems that don’t interoperate.”

Blockchain rails for settlement stood out for their ability to enable instant global transactions, operating 24 hours a day, 7 days a week, 365 days per year. Stablecoins complement this system and serve as an ideal currency on the blockchain due to their stability and reliability.

Our goal at Worldpay was to introduce stablecoins as a settlement currency, enabling our clients globally to accept customer payments in fiat while receiving the settlement proceeds in stablecoins.

“Moving our settlements to the blockchain provides Worldpay with a single unified payments rail and globally accepted currency. Using a single blockchain protocol rather than hundreds of local payment rails is attractive to a large-scale, global company like Worldpay,” Manji continues.

A complex challenge quickly surfaced: integrating the Worldpay platform and treasury operations using traditional rails with new blockchain-based rails. “Worldpay is integrated with traditional financial services rails like SWIFT or local payment rails. Integrating our platform with blockchain payment rails is not straightforward,” Manji details.

Solution: Empowering Worldpay to Build on the Blockchain

Worldpay knew it needed a trusted partner with the right expertise and technology to help it deliver on its strategic plan. There were two key evaluation criteria. “First, we wanted to work with a company that had expertise in not only blockchain technology but also had deep knowledge of consumer payments,” says Manji. “Second, we needed a provider with an enterprise mindset regarding security, scalability, and infrastructure resilience.”

This led the Worldpay team to Fireblocks. Manji concludes, “When looking for a company that provides the intersection of blockchain and payments expertise with an enterprise-grade platform, Fireblocks clearly comes out on top.”

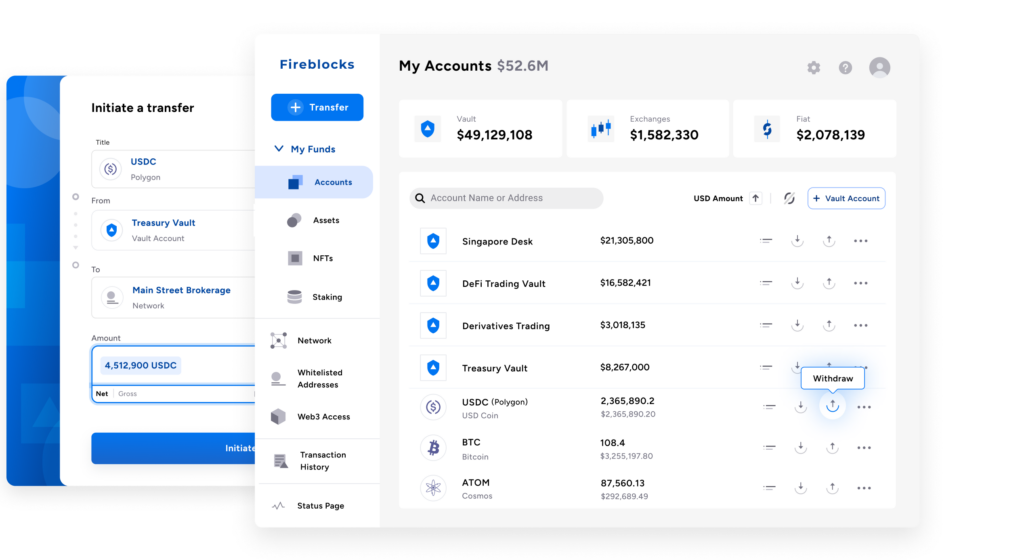

Fireblocks Payments Engine provides Worldpay with tools and an ecosystem to orchestrate, transfer, and settle stablecoin payments across any blockchain and geography. With a single platform, they can quickly build custom payment flows, on and off-ramp fiat & stablecoins, and provide their treasury teams with complete visibility throughout the payment settlement lifecycle. Using the Payments Engine and blockchain technology, funds are moved from the US to merchants in different jurisdictions in seconds.

Another important criteria for selecting the Fireblocks platform was the ability to settle with merchants on over 40 blockchains.

One of the really great things about Fireblocks is that we’re able to be blockchain agnostic – each merchant has their preference about which blockchain they want to receive stablecoins. The fact that Fireblocks supports so many blockchains was a really big selling point for us.

Part of what enabled Worldpay to get to market quickly was the Payment Engine’s reporting capabilities, which allowed its treasury teams to receive settlement information within their existing data structures and formats. By integrating blockchain reporting and reconciliation into Worldpay’s existing systems, they were able to significantly reduce the complexity of implementing a new payments rail.

The Fireblocks Policy Engine also provided Worldpay with the flexibility to configure governance and user permissions to meet their demanding risk and compliance requirements. Worldpay used the Policy Engine to enforce segregation of duties and ensure that the required approvals were met before a settlement was initiated. The Policy Engine gave Worldpay confidence that their new merchant services met the compliance standards required of a business operating in highly regulated markets.

“Having all the enterprise capabilities and ecosystem connectivity pre-built into the Fireblocks platform, as well as being able to support our custom configurations, means that we can confidently scale our solution with the right partners and technology.”

Results: Delivering Unmatched Settlement Speeds for Merchants

Worldpay achieves 50% faster payment processing by adopting stablecoin settlements

Worldpay’s new stablecoin settlement solution now provides merchants, such as Banxa and Crypto.com, unmatched speed – enabling them to access settlement funds days sooner than traditional fiat rails with 50% efficiency boost.

At the same time, their new stablecoin settlement solution cuts down on the fees and costs associated with traditional rails and offers better reconciliation.

“The Fireblocks Payments Engine has allowed us to open the world of blockchain-based payments to our clients in a way that meets our security, scalability, and compliance requirements.”

Worldpay is committed to extending its new merchant settlement solution to deliver T+0 settlements to all its clients. And with the Payments Engine, they can continue pushing the boundaries and testing new use cases for blockchain-based payments.

“It was really important to us when evaluating the right partner and platform to support the blockchain-based payment solutions that we chose someone who can not only support what we’re building today but also the use cases we’re looking to enable in the future,” says Manji. “So, as we look to provide faster payouts to our merchants with stablecoins or support CBDCs for B2B and B2C payments, having a partner that we’re able to scale and explore with is really important to Worldpay.”

Expanding settlement vertically in the ecosystem

In addition to Worldpay and Fireblocks undertaking the merchant’s settlements initiative, other interesting blockchain initiatives are underway, such as the one recently announced by Visa.

In this case, Fireblocks provides Worldpay with the infrastructure to settle received payments over the Solana blockchain, improving the settlement time for receiving funds and payments and enhancing capital efficiencies. The USDC settlement services streamline transactions, ensuring merchants faster access to funds, enhancing liquidity, and aiding cash flow management, which is critical in a higher interest rate climate.

By partnering with Fireblocks, Worldpay has become a vanguard of payment processing innovation, successfully establishing a 24/7 merchant settlement system using stablecoins and expanding this settlement framework across the ecosystem to card schemes like Visa.

Today, Fireblocks’ infrastructure is used by more than 100 payment companies to securely settle a monthly average of 1.5 million transactions worth more than 10 billion dollars.

Get a personalized demo

See how Fireblocks helps your digital asset business to grow fast and stay secure