According to our 2025 State of Stablecoins report, only 10% of respondents said they were undecided on stablecoin adoption. Stablecoins are becoming a core component of modern payment rails as payment providers, banks, and fintechs look to move faster, expand globally, and stay competitive.

At Fireblocks, we’ve spent the past five years building digital asset infrastructure with over 300 financial institutions. Stablecoins are now central to many of their strategies. In 2024 alone, our platform processed more than $1.5 trillion in stablecoin transactions. What represented just 20% of our total volume in 2020 now accounts for over 55%. Today, 10–15% of all global USDC and USDT flows are routed through Fireblocks.

The message is clear: interest is no longer the constraint. Execution is. And at scale, execution depends on infrastructure. The architecture you choose today will determine how effectively you grow, adapt, and stay ahead.

These five infrastructure imperatives define what scalable success looks like.

1. Leverage Infrastructure That Scales with Your Stablecoin Journey

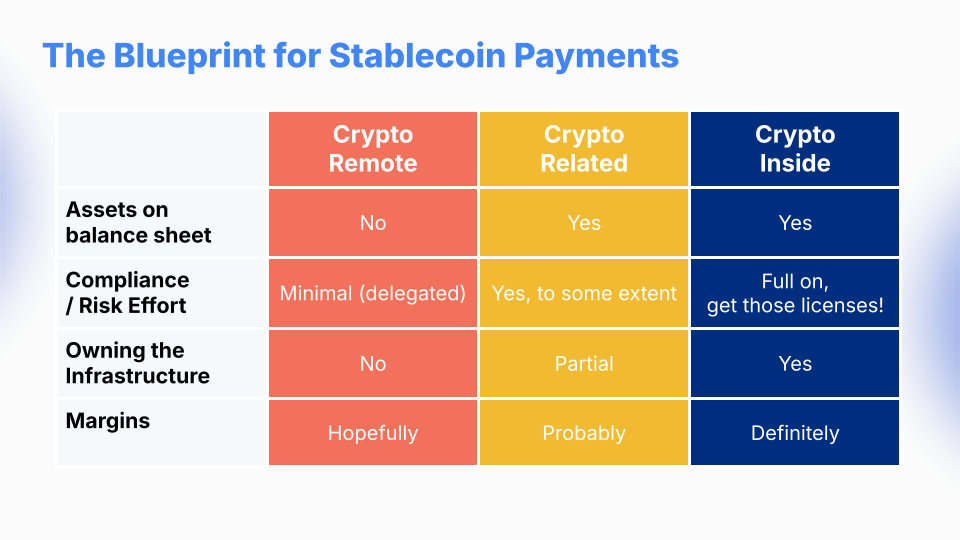

Every payments provider starts somewhere on the stablecoin adoption journey. Some of you enter the market as Crypto-Remote, working through partners to provide basic stablecoin capabilities while keeping digital assets off the balance sheet. But our experience tells us that you will evolve your approach in order to:

- control the transaction flow and settlement process;

- own your customer experience;

- capture margin gains; and

- mitigate risk.

You may make an interim step to Crypto-Related, managing wallet infrastructure with a partner, for example. Or like many today, you will go straight to where you will eventually end up if you want to manage the margins: Crypto-Inside, with direct control over transaction orchestration and ownership of digital asset operations.

Not every payment provider will follow the same journey—but every path moves toward deeper control, tighter integration, and greater strategic value. The stablecoin infrastructure you choose will shape how fast you move, how much margin you capture, and how well you adapt. What matters most is having infrastructure that keeps pace with your ambition.

2. Map Your Technical Requirements to Your Use Case(s)

As Solana Foundation’s Sheraz Shere points out, payment providers enter the stablecoin space in different ways—some begin with custody, others with cross-border payouts or merchant settlement.

Each use case brings its own technical demands. That’s why it’s essential to align your infrastructure with what you’re actually building—whether you’re moving, holding, or managing funds. From internal treasury management and cross-border payments solutions to stablecoin issuance and merchant settlement, each has distinct architectural requirements.

As your strategy evolves, your infrastructure should be able to support new use cases—without requiring a replatform.

For example:

- Cross-border flows need access to liquidity, compliance infrastructure, and globally-compatible wallets.

- Merchant settlement requires orchestration tools for real-time payouts, wallet routing, and FX conversion.

Zeebu, operating in telecom payments, built for high-volume B2B settlements from the start. Automation was key. Within two months of using Fireblocks Automation, they executed over 30,000 automated actions—moving more than $350M. Today, their stack supports $5.7B in settlements and 99,000 invoices across 139 carriers. Their scale is a direct result of purpose-built infrastructure.

Your stablecoin infrastructure must scale with rising transaction volumes—and be resilient enough to support whatever use cases come next.

3. Embed Enterprise-Grade Security and Risk Resilience

With stablecoins, settlement is instant and irreversible. That’s why security needs to be embedded from day one. The industry recognizes this: 36% of institutions in the State of Stablecoins 2025 survey say better protection would unlock further adoption.

There are proven methods for achieving enterprise-grade security—which also support the seamless compliance you require:

- use Multi-Party Computation (MPC), which eliminates single points of failure by distributing key shares across isolated environments;

- use a policy engine that automates authorization workflows;

- ensure uninterrupted business continuity to prevent operational downtime and potential funds loss while complying seamlessly with regulatory requirements.

RedotPay’s co-founder Jonathan Chan explains: “Navigating the complex landscape of digital assets technology and regulatory frameworks necessitates robust, secure infrastructure. Furthermore, with the majority of our users being everyday consumers, it is our utmost priority to provide reliable security.”

Fireblocks provides us with advanced MPC solutions for private key management and flexible capabilities through their TAP framework. This allows RedotPay to maintain high security standards while offering our users seamless service.

4. Make Compliance a Built-In Advantage

In 2023, 74% of institutions cited compliance as a barrier to stablecoin adoption. In this year’s State of Stablecoins report, just 18% said the same. The drop reflects growing confidence that regulatory demands can be met—if the right infrastructure is in place from the start.

To ensure your business is ready for evolving compliance expectations, choose infrastructure with integrated tools that support scale, enable efficiency, and meet regulatory standards with confidence:

- Wallet Screening: Continuously monitor wallet addresses to detect suspicious or sanctioned entities before transactions are initiated. This provides an essential first line of defense against financial crime and regulatory breaches.

- Transaction screening: Enable real-time transaction screening, risk scoring, and compliance actions for all inbound and outbound transactions.

- Automated Travel Rule Compliance: Implement automated information sharing between VASPs to comply with the Travel Rule across jurisdictions. This minimizes operational burden while maintaining regulatory adherence for both domestic and cross-border payments.

- Audit-Ready Reporting: Maintain comprehensive logs and real-time reporting capabilities across asset flows and transaction histories. This ensures readiness for internal audits, external reviews, and regulatory disclosures without adding friction to operational workflows.

Banking Circle understands that compliance needs to be integral to their operations. They used Fireblocks’ Tokenization Engine to issue EURI—the first MiCA-regulated stablecoin backed by a bank. Compliance controls were built into the issuance flow. Minting and burning were automated, triggered by fiat movements in and out of their bank account.

5. Solve for Liquidity and On/Off-Ramp Efficiency

There are two issues here. First, you need access to on/off ramps that cover your required currencies, have redundancy options built in, and enable easy integration. Second, these on/off ramps have to be highly liquid so they can handle large volumes and be cost efficient. Liquidity is a critical factor in stablecoin strategy success. Even with the payout flows, insufficient access to on/off ramps can stall scale.

You need a single platform to reach stablecoin issuers, liquidity providers, exchanges, OTC desks, and fiat rails—and the ability to route transactions efficiently across them. Manual processes won’t cut it. Automated routing helps optimize for deep liquidity pools in order to reduce cost, manage availability, and ensure redundancy.

This is why you need stablecoin infrastructure that delivers built-in connectivity to the ever-growing digital asset ecosystem. The Fireblocks Network provides that connectivity—to more than 2,000 institutional counterparties, including exchanges, liquidity providers, on/off ramp partners, token issuers, qualified custodians, market makers, and more, greatly reducing operational overhead while maximizing capital efficiency. You access built-in services to discover, connect, secure transfers, distribute assets, and mitigate counterparty risk, all while maximizing liquidity access.

Conduit recently saw this work in practice when the Circle Payments Network (CPN) went live. It used Fireblocks to access CPN without rebuilding its core systems. Fireblocks enables custody, treasury management, and CPN connectivity from the same environment, removing unnecessary friction and allowing Conduit to scale global payment flows efficiently.

Maria Bello, Senior Product Manager at Bitso explains it this way:

One challenge that we faced before we integrated with Fireblocks is that we were building our own, in-house solution for wallet management, which was expensive. We needed to create a new node for each network that we wanted to integrate, so the cost of maintenance was super high; we couldn’t offer the best user experience to scale our business.

Conclusion: The Infrastructure You Choose Defines Your Advantage

Stablecoin infrastructure is not a single system. It’s a coordinated set of capabilities, including security, compliance, orchestration, and network access, which determine how efficiently you can operate, scale, and compete.

Vay Tam, President and CRO of publicly-listed crypto payments provider ALT 5 Sigma puts it this way:

We’re seeing that the amounts are getting bigger, the frequency and volumes, the TPS are getting much larger so there’s a scaling effect that’s happening…Fireblocks is obviously a big part of our success and our ability to scale. As we evaluated a number of vendors and service providers, the comment that kept coming back constantly was that Fireblocks was the simplest to get up and running. Where we wanted this is the ability to scale quickly and be able to sleep at night with security.

Execution depends on infrastructure. It’s the difference between moving fast and just moving. Fireblocks has already helped more than 2000 companies move over $1.5T in stablecoin flows. Build it right from the start. Schedule a Fireblocks demo to design the stablecoin infrastructure your business needs.