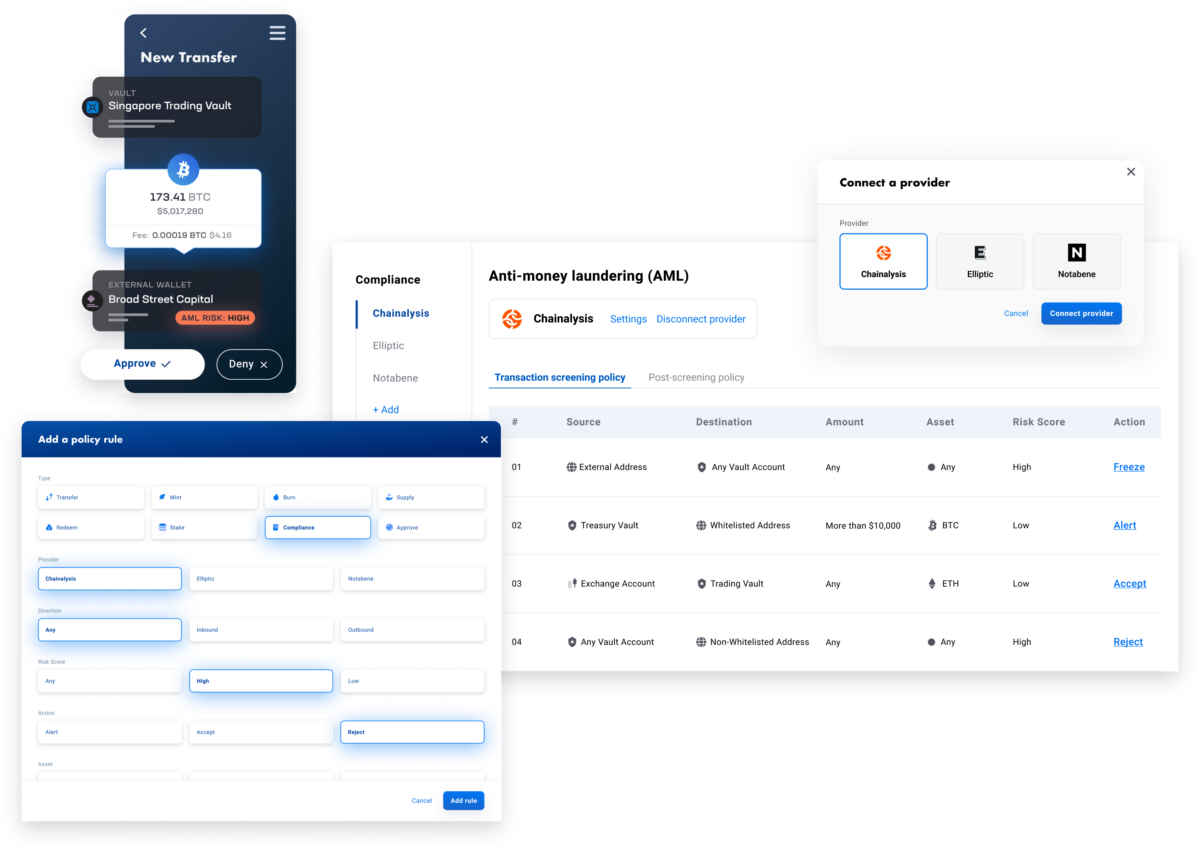

COMPLIANCE INTEGRATIONS

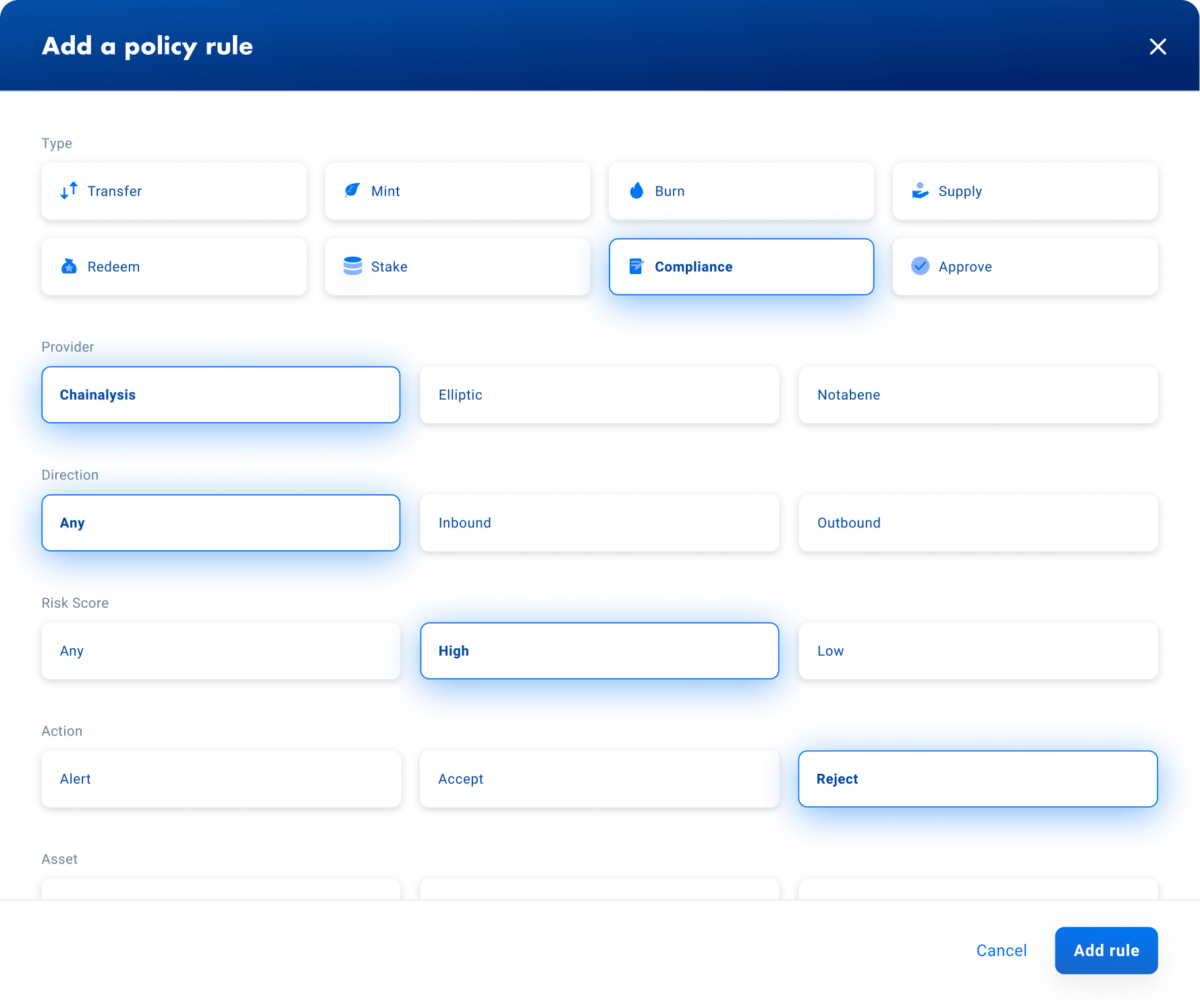

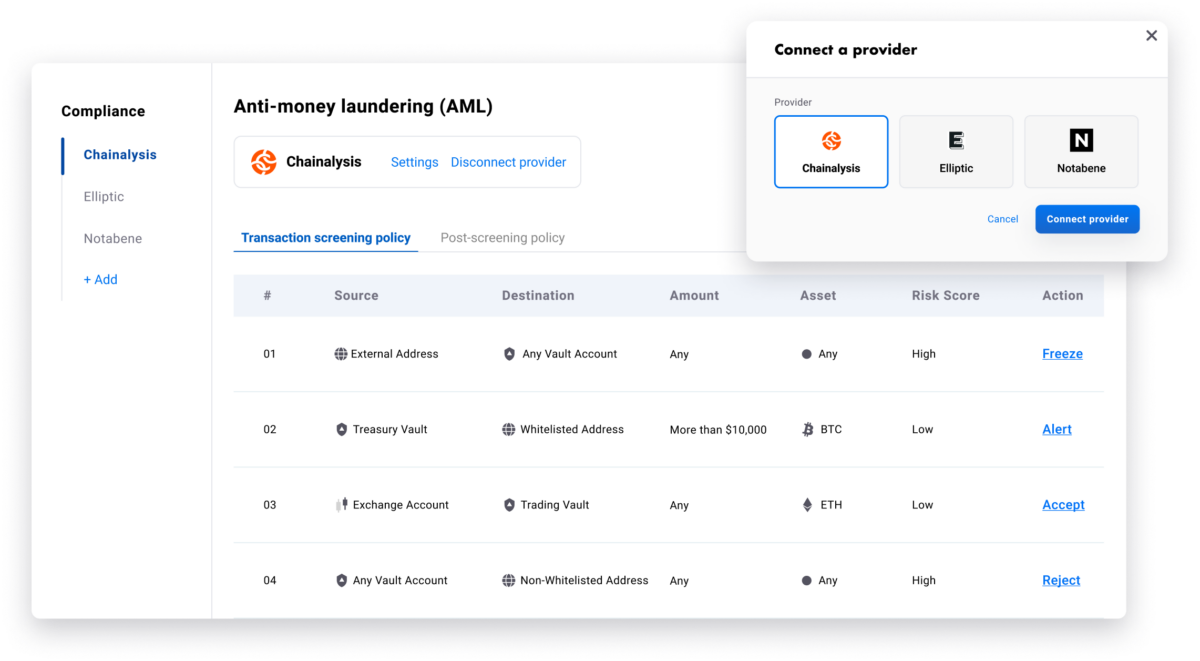

Easily configure and automate compliance for digital assets

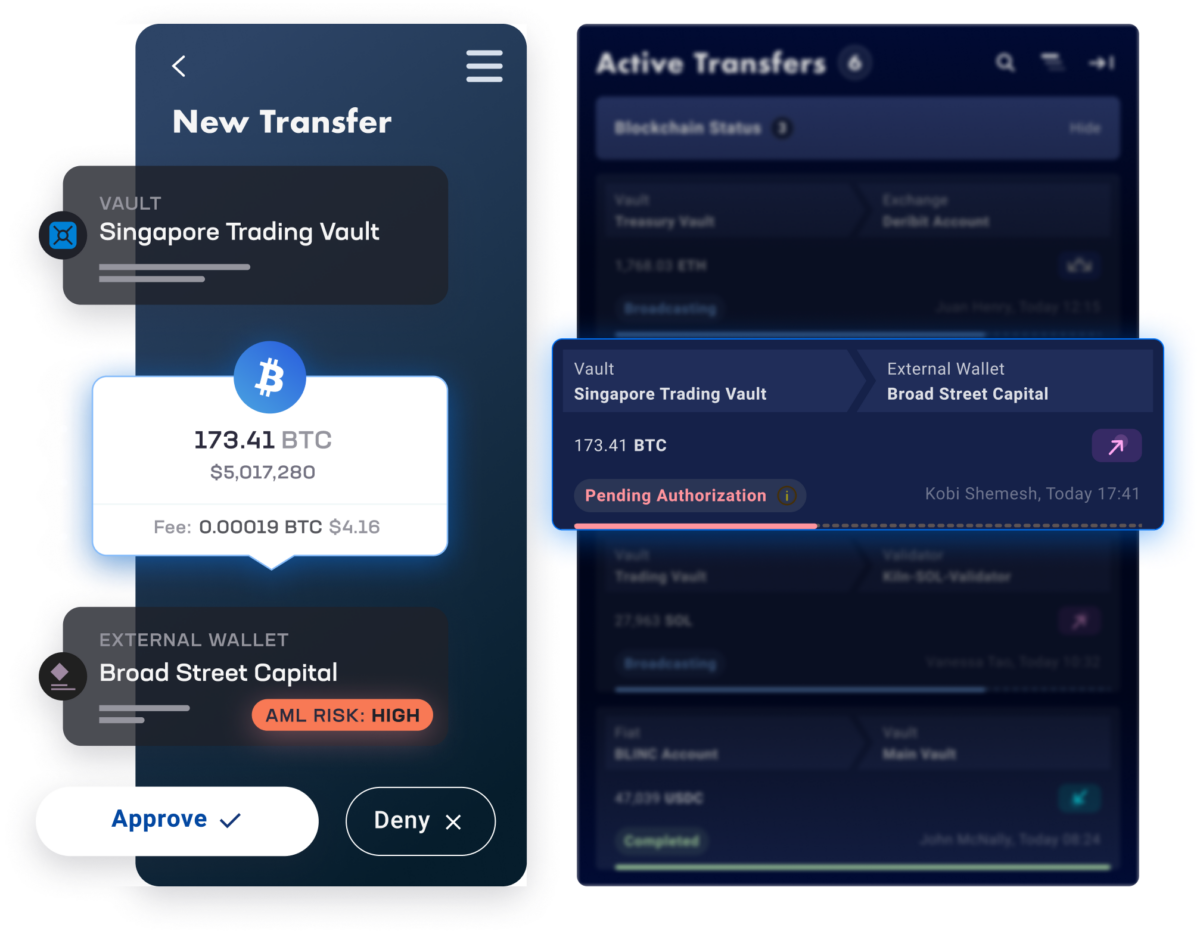

Fireblocks compliance integrations are the simplest way for compliance teams to meet evolving digital asset regulatory requirements and address the latest industry threats. Fireblocks partners with industry-leading digital asset compliance solutions to provide real-time transaction monitoring directly from the Fireblocks platform.