Tokenization, or the process by which assets are converted into tokens that can be moved, stored, or recorded on a blockchain, enables a transparent, well-governed financial system. It empowers interested participants to utilize financial services and access capital markets with ease and efficiency.

We’re currently seeing active examples of tokenization projects across multiple asset classes, such as commodities, debt securities, equity securities, and real estate.

Their place in the digital asset marketplace has grown to a size that has not gone unnoticed by investors, retail and institutional alike.

In this blog post, we’ll walk you through three of the most prominent examples of tokenization initiatives, and explore their impact on the digital asset landscape, including:

- Paxos Digital Gold Token (PAXG)

- Overstock.com STO (Digital Dividend)

- DBS Bank Singapore’s Tokenized Bond

Tokenization Project 1: Paxos Gold Digital Token (PAXG)

Paxos Gold Digital Token (PAXG) is an asset-backed digital token approved and regulated by the New York State Department of Financial Services, with a total market capitalization of $327 million. The token has seen a steady increase in market capitalization since it was initially issued in September 2019.

As a collateralized stablecoin, PAXG requires the purchase of physical gold to back the issuance of new tokens, and is therefore limited to Paxos’ ability to maintain its supply of gold to meet demand for PAXG.

On average, PAXG daily trading volume has been approximately 4.8% of market capitalization, while GLD daily trading volume has been approximately 2.5%.

The higher trading volume demonstrates the attractiveness of tokenizing digital assets. Paxos has been able to remove custody fees and decrease the minimum purchase amount, as well as offer instant settlement of tokens to investors – making it a more appealing option to many investors.

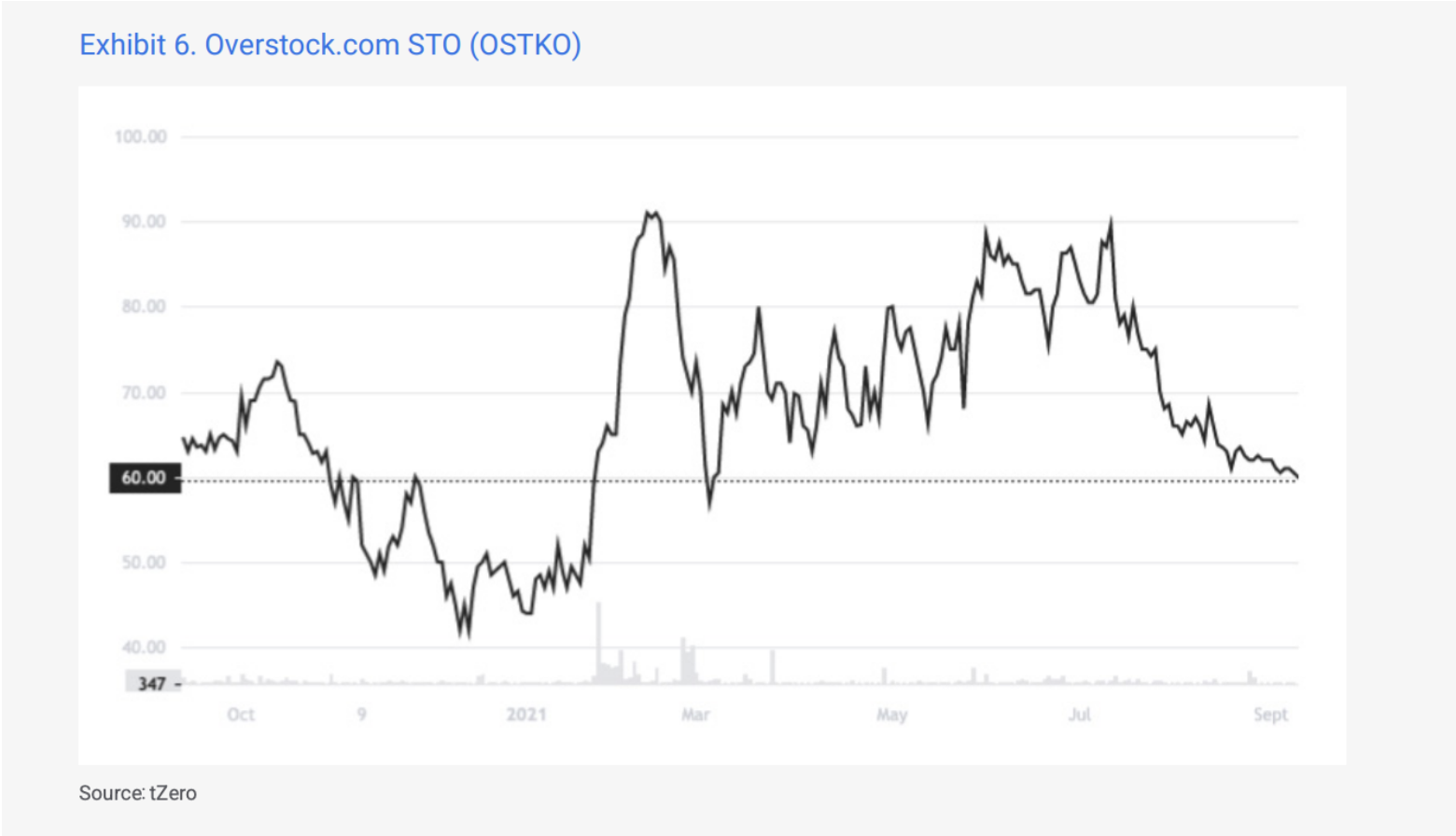

Tokenization Project 2: Overstock.com STO (Digital Dividend)

Listing requirements for NASDAQ and NYSE include company market value ranges between $45-100 million. One of the largest security token offerings (STO) has been Overstock.com, a tech-driven online retailer, with current STO market capitalization of $275 million.

STO brings the benefits of tokenization to shareholders, presenting a more efficient digital dividend.

With STO, Overstock.com has been able to automate corporate actions, lower administrative costs, increase liquidity, and up access to capital markets.

Issued in April 2020 using the Tezos blockchain (based on the ERC-20 token standard), these preferred shares receive cash distributions via dividends.

The market capitalization of the S&P 500 is $37.2 trillion. The tokenization of digital assets provides an opportunity to list certain classes of shares for specific purposes on alternative venues.

Tokenization Project 3: DBS Bank Singapore’s Tokenized Bond

DBS Bank (DBS) issues debt in various currencies; for example, the March 2021 subordinated debt issuance for U.S. Dollars denominated $500 million. DBS also holds 34% market share in the Singapore Dollar (SGD) debt market, issuing SGD $5.85 billion in 2019.

DBS issued its first tokenized bond of SGD $15 million in 2021, fully subscribed through DBS FIX Marketplace. DBS FIX Marketplace is a fully digital and automated fixed income execution platform; the app also manages legal, operational, and sales-related transactional data flows and documentation. The platform enables investors to participate with a minimum ticket size of $10,000 (versus $250,000 for traditional bond issuance), making it very accessible for the broader market.

In general, tokenized debt issuances have started to attract corporate attention given their issued size and tenor, primarily in Asian and European markets.

Launching tokenization at your organization

The tokenization of digital assets is primed to alter the way financial markets work across the board. Tokenization offers conveniences that traditional assets cannot, as seen with PAXG; it also enables easier digital dividend distribution, as seen with STO; and it improves various aspects of corporate debt markets, as seen with SGD.

If your organization is interested in taking a closer look at tokenization and its impact on finance, read our newest whitepaper, Tokenization: The Foundation of Digital Financial Markets, to learn more.